In India, personal finance has always been human-led. Even today, most people rely on chartered accountants (CAs) and accountants for tax filing, compliance, and investment decisions. However, with growing concerns around data privacy, paid subscriptions, and bank-account linking in finance apps, many users are now exploring AI for money management as a safer and more controlled way to understand their finances. Instead of replacing professionals, AI is increasingly being used as a thinking and understanding assistant that helps people make sense of budgets, taxes, and financial choices—while staying fully in control of what data they share.

This is where AI is quietly becoming useful — not as a replacement for professionals or apps, but as a thinking and understanding tool.

Instead of tracking users in the background, AI helps people understand their money, prepare better, and ask the right questions — while staying in control of what data they share.

Table of Contents

Why Many People Avoid Finance Apps (The Ground Reality)

Finance apps offer convenience, but hesitation is real and widespread.

Common concerns include:

Sharing full bank statements and transaction history

Granting continuous SMS or email access

Useful features locked behind paid plans

Multiple apps doing almost the same thing

Dashboards that confuse non-technical users

For many households, clarity, control, and trust matter more than automation.

How AI Is Fundamentally Different

The biggest difference lies in data control.

Finance apps usually work like this:

“Give me access to everything. I’ll analyse it for you.”

AI works like this:

“Share only what you are comfortable with. I’ll help you understand it.”

With AI:

You decide how much data to share

You choose the time range (one week, one month, etc.)

You can use approximate or rounded figures

Data can be shared as text, Excel, PDF, or even images

There is no permanent access and no background tracking.

How Can AI Help With Budgeting (Without Tracking You)

AI does not need your bank login to help with budgeting.

If you share:

Monthly income (even approximate)

Major expense categories

A savings goal

AI can:

Create a realistic monthly budget

Identify overspending areas

Suggest practical saving targets

Adjust plans when income changes

This works especially well for people who want guidance without surveillance.

AI Explains Financial Behaviour (Not Just Numbers)

Most apps show charts.

AI explains why things are happening.

Instead of:

“Your expenses increased by 10%”

AI explains:

“Your discretionary spending is rising faster than income, which is why savings feel inconsistent.”

This explanation helps users learn, not just observe.

AI For Tax Understanding (Not Tax Filing)

Most people don’t want to file taxes themselves — they want to understand them.

AI can help by:

Explaining tax sections in simple language

Clarifying old vs new tax regime logic

Explaining deductions and exemptions

Preparing users before meeting their CA

This leads to:

Better conversations with professionals

Fewer last-minute mistakes

More confidence in decisions

The CA still files the return. AI only helps with understanding and preparation.

AI can help explain tax concepts, but official rules and filings should always follow guidance from the Income Tax Department of India.

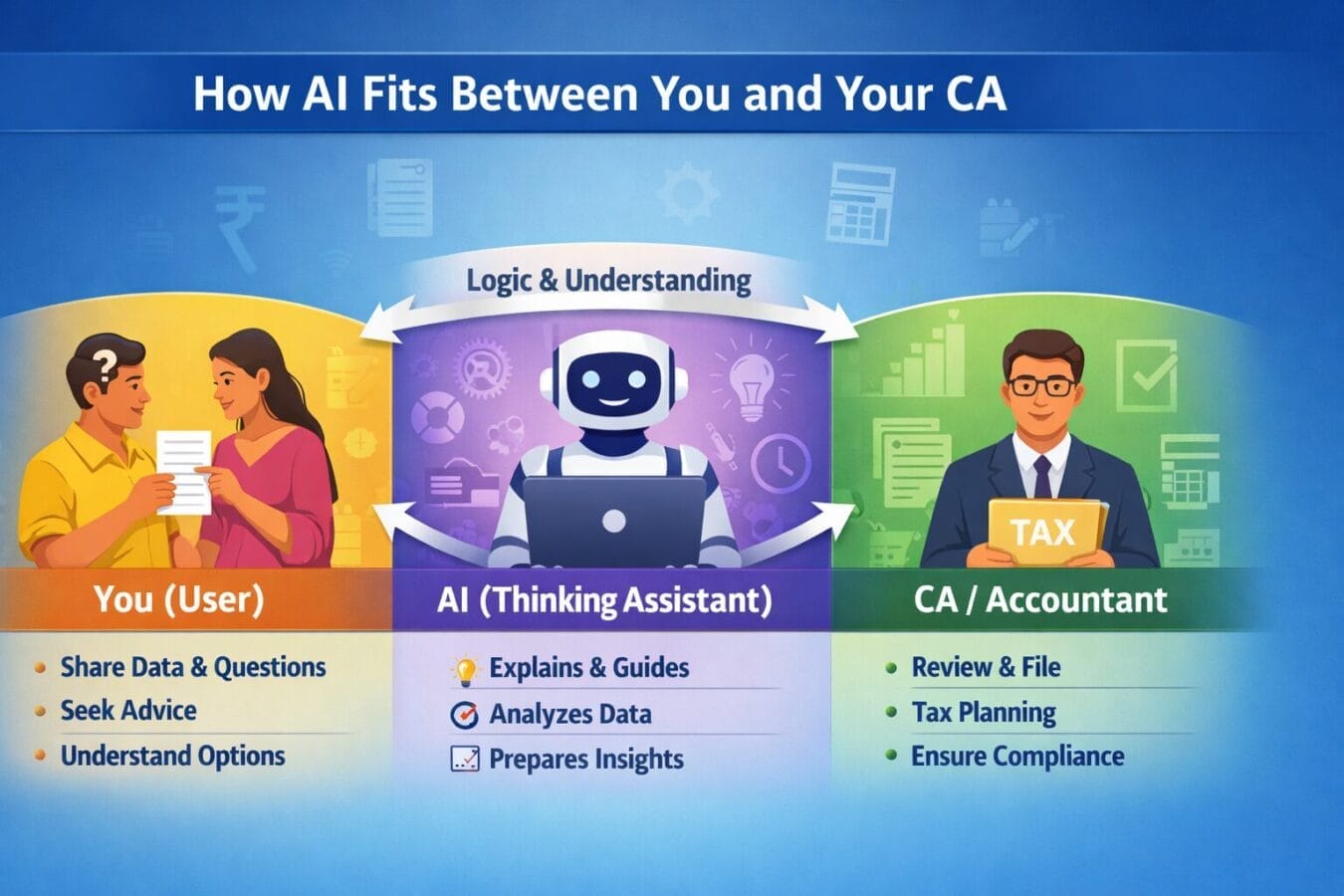

Logic Flow: How AI Fits Between You and Your CA

You (User):

Share limited information

Ask questions

Decide what you are comfortable sharing

AI (Thinking Assistant):

Explains concepts clearly

Highlights options and trade-offs

Prepares you to ask the right questions

CA / Accountant (Final Authority):

Reviews documents

Applies tax laws

Files returns

Ensures compliance

Key point:

AI does not replace the CA.

AI sits between confusion and clarity.

Privacy Pro-Tip: Share Only “Safe Data”

One of the biggest advantages of using AI for finance is controlled data sharing.

Pro-Tip: Scrub Sensitive Details Before Sharing

Before pasting any data into AI, always remove:

Name

Bank account number

UPI ID

Mobile number

Exact transaction references

What to keep:

Dates (optional)

Amounts

Categories (rent, groceries, EMI, etc.)

Approximate income or expense ranges

Example:

Instead of:

“₹4,500 spent via HDFC Account 1234 at XYZ Store on 12 June”

Use:

“₹4,500 spent on shopping on 12 June”

AI does not need identity details to detect patterns or give insights.

Government agencies like CERT-In regularly advise users to limit unnecessary data sharing online

Gemini / ChatGPT Prompts For Money Management (Practical & Safe)

Readers can copy-paste these prompts directly.

1. Budget Planning

“My monthly income is around ₹55,000. Fixed expenses are rent ₹15,000, EMI ₹8,000, groceries ₹7,000. I want to save ₹8,000 monthly. Create a realistic budget.”

2. Expense Understanding

“Here are my expenses for the last 7 days. Can you identify unnecessary spending and suggest improvements?”

3. Tax Understanding

“I am a salaried employee earning around ₹9 lakh per year. Explain which tax deductions I should understand before meeting my CA.”

4. Old vs New Tax Regime

“Explain the difference between old and new tax regimes for income around ₹10 lakh, without giving filing advice.”

5. Savings Habit

“I save money irregularly. Suggest a simple saving strategy based on my income and expenses.”

6. Pre-CA Meeting

“What questions should I ask my CA to ensure I am not missing any legal tax-saving opportunities?”

Common Mistakes People Make When Using AI for Money Management

1. Treating AI as a Replacement for a CA

AI prepares you; the CA executes.

2. Sharing Too Much Sensitive Data

AI does not need names or account numbers.

3. Expecting Exact Numbers or Guarantees

AI explains logic, not certainty.

4. Asking Vague Questions

More context = better guidance.

5. Blindly Following AI Output

Always understand and verify.

6. Using AI in Panic Mode

AI supports calm, rational thinking.

7. Thinking Perfect Data Is Required

Approximate data works well.

What AI Cannot and Should Not Do

AI cannot:

Access live bank accounts

Execute transactions

File tax returns

Replace licensed professionals

AI is best used for:

Understanding

Planning

Learning

Decision support

The Indian Way Forward: AI + Human Experts

India trusts human expertise — and rightly so.

AI fits naturally as:

A learning companion

A preparation tool

A confidence builder

The future is:

AI for understanding + professionals for execution

Final Thoughts

Finance apps manage data.

CAs manage compliance.

AI helps people understand both.

For users worried about:

Data privacy

Paid subscriptions

App overload

AI offers a controlled, human-centric way to become financially smarter — without replacing anyone.

Disclaimer

AI tools are for informational and educational purposes only. They do not replace professional financial or tax advice. Always consult a qualified CA or financial expert for final decisions.

Trending

Ayush Singhal is the founder and chief editor of TechMitra.in — a tech hub dedicated to simplifying gadgets, AI tools, and smart innovations for everyday users. With over 15 years of business experience, a Bachelor of Computer Applications (BCA) degree, and 5 years of hands-on experience running an electronics retail shop, Ayush brings real-world gadget knowledge and a genuine passion for emerging technology.

At TechMitra, he covers everything from AI breakthroughs and gadget reviews to app guides, mobile tips, and digital how-tos. His goal is simple — to make tech easy, useful, and enjoyable for everyone. When he’s not testing the latest devices or exploring AI trends, Ayush spends his time crafting tutorials that help readers make smarter digital choices.

📍 Based in Lucknow, India

💡 Focus Areas: Tech News • AI Tools • Gadgets • Digital How-Tos

📧 Email: contact@techmitra.in

🔗 Full Bio: https://techmitra.in/about-us/