India’s OTT battleground saw major shifts in the final quarter of 2025.

According to a newly released Q4 2025 Streaming Market Share Report by JustWatch, Prime Video has taken a decisive lead in the Indian streaming market, capturing 25% market share — the highest among all platforms.

The quarterly study, based on viewing activity from nearly 16 million Indian users, tracks how audience preferences evolved throughout 2025 and which platforms gained or lost momentum heading into year-end.

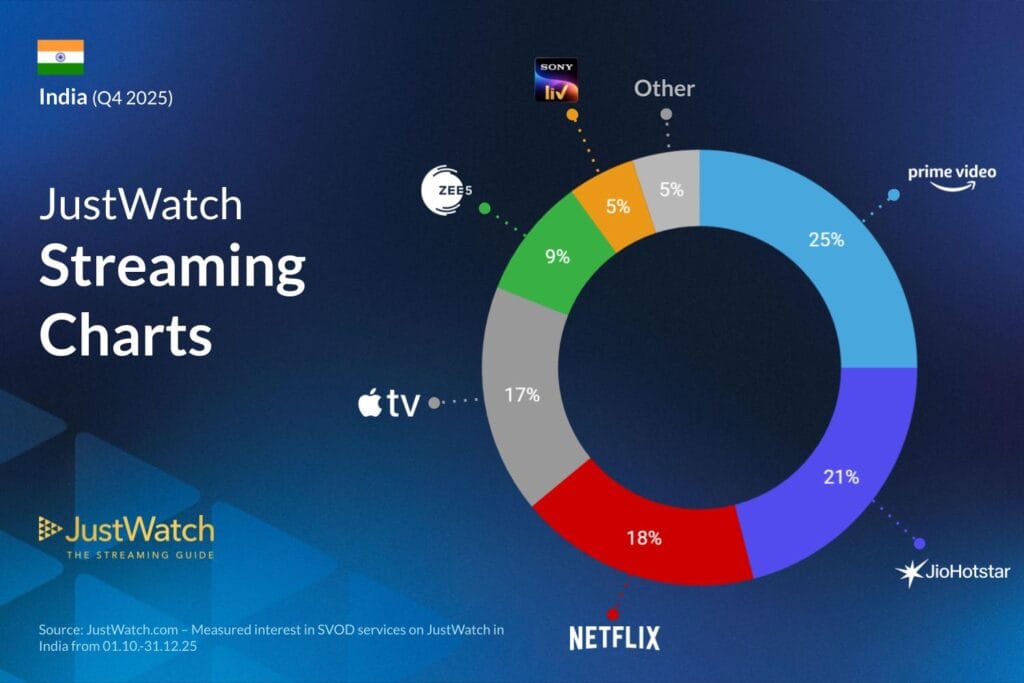

SVOD Market Share in India – Q4 2025

Top platforms by market share:

- Prime Video – 25%

- Jio-Hotstar – 21%

- Netflix – 18%

- Apple TV+ – 17%

- Zee5 – 9%

- SonyLiv – 5%

- Other platforms – 5%

Prime Video not only retained its leadership position but also posted the strongest quarterly growth, gaining +2 percentage points in Q4 alone.

Jio-Hotstar secured second place with 21%, despite a minor quarterly decline, while Netflix slipped to third after losing one percentage point during the same period.

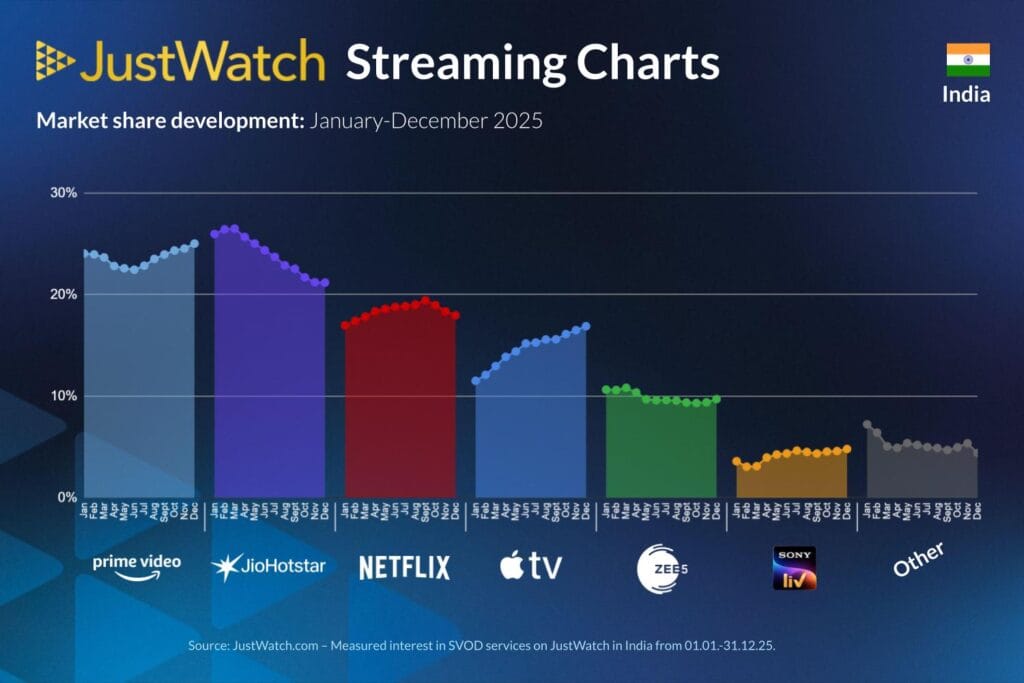

Apple TV+ Records Biggest Year-on-Year Growth

While Prime Video leads overall, Apple TV+ delivered the most impressive annual performance.

The platform grew by +6 percentage points year-over-year, making it the fastest-growing OTT service in India during 2025. Netflix, on the other hand, showed modest annual growth but faced quarterly pressure as competition intensified.

Zee5 experienced a slight decline over the year, whereas SonyLiv remained largely stable with small annual gains.

Notably, year-on-year comparisons for Jio-Hotstar were not available due to the merger of JioCinema and Disney+ Hotstar in early 2025, which reshaped India’s streaming ecosystem.

Market Development Trends Through 2025

The report highlights how platform positions shifted across the year:

- Prime Video gained momentum late in 2025 despite a slight annual dip

- Apple TV+ consistently climbed throughout the year

- Netflix faced quarterly volatility

- Smaller platforms maintained relatively stable shares

JustWatch calculates these market shares based on real user engagement, including watchlist additions, clicks to streaming services, filtering activity, and marking titles as “seen.” In other words, this data reflects actual viewer behavior, not just subscriber numbers.

TechMitra Take

India’s streaming market is clearly entering a new competitive phase.

Prime Video’s dominance shows the impact of aggressive content investments and bundled pricing strategies. Apple TV+’s rapid rise proves that premium global originals are resonating strongly with Indian audiences. Meanwhile, Netflix — once the undisputed leader — now faces serious pressure from both established players and fast-growing challengers.

For consumers, this growing competition means better content choices and more innovation. For platforms, 2026 is shaping up to be a decisive year in India’s OTT race.

This comes amid broader changes across India’s digital entertainment ecosystem, including recent developments like Jio Hotstar introducing AI-powered features at its 48th AGM.

Methodology: How JustWatch Calculates Streaming Market Share

JustWatch India Report determines SVOD market share based on real user engagement, not subscriber numbers.

The data is collected from interactions across its website, mobile apps, and TV platforms between January 1 and December 31, 2025. Market share is calculated using signals such as:

- Adding movies or TV shows to watchlists

- Clicking through to streaming services

- Filtering multiple platforms while browsing content

- Marking titles as “seen”

This approach reflects actual viewing intent and discovery behavior, offering a realistic picture of which platforms users actively engage with.

JustWatch also operates daily-updated Streaming Charts across more than 140 countries, tracking popularity based on millions of monthly users worldwide. All figures in this report are rounded to the nearest whole percentage point.

About JustWatch

JustWatch is the world’s largest streaming guide, helping users discover where to legally watch movies, TV series, and sports content across hundreds of platforms.

The company serves over 60 million monthly users globally and tracks viewing trends across more than 4,500 streaming services. Headquartered in Berlin, Germany, JustWatch also maintains offices in New York, Los Angeles, Paris, Munich, and London.

Its platform aggregates availability from major services such as Prime Video, Netflix, Apple TV+, and many others — making it easier for viewers to find what to watch and where to stream it.

Source: Q4 2025 SVOD Market Shares Report by JustWatch, based on streaming activity from ~16 million Indian users.

Ayush Singhal is the founder and chief editor of TechMitra.in — a tech hub dedicated to simplifying gadgets, AI tools, and smart innovations for everyday users. With over 15 years of business experience, a Bachelor of Computer Applications (BCA) degree, and 5 years of hands-on experience running an electronics retail shop, Ayush brings real-world gadget knowledge and a genuine passion for emerging technology.

At TechMitra, he covers everything from AI breakthroughs and gadget reviews to app guides, mobile tips, and digital how-tos. His goal is simple — to make tech easy, useful, and enjoyable for everyone. When he’s not testing the latest devices or exploring AI trends, Ayush spends his time crafting tutorials that help readers make smarter digital choices.

📍 Based in Lucknow, India

💡 Focus Areas: Tech News • AI Tools • Gadgets • Digital How-Tos

📧 Email: contact@techmitra.in

🔗 Full Bio: https://techmitra.in/about-us/